Deputy Chairman of Gazprombank Dmitry Zauers talks in an interview with "Kommersant Money"

"The winner is not the first one to start the race but the one who reaches the finish line"

|

For two years, Gazprombank has been implementing a large-scale project to transform its business model. Deputy Chairman of Gazprombank Dmitry Zauers talks in an interview with “Kommersant Money” about why the bank is rapidly transforming from a corporate investment lender into a universal bank with a focus on active development of retail, how to boost its customer base to tens of millions of people, and what its future financial ecosystem might look like. |

Dmitry, Gazprombank has in some ways always been shrouded in secrecy, so first of all I would like to ask a simple, or perhaps a challenging question – what keeps the bank going nowadays?

— Next year, Gazprombank will celebrate its 30th anniversary, so I think it would be fitting to compare it with a person at this age. The bank has great ambitions, although perhaps it has not yet made any final decision about what its goals should be. But it can change, it has great potential, and, most importantly, it is able to quickly run along the planned route. The speed at which Gazprombank has been changing over the past two years is absolutely unprecedented both in terms of the bank itself and compared to other market players. We manage to get many things done quickly that our competitors have spent many years on. I feel confident that this is the key to our success.

— Since you mention changes, from the beginning of 2018 Gazprombank has been actively transforming its business model. Why did you decide that something needed to be changed?

— First of all, I would like to say that operations in the corporate sector have been and will remain a large and very important part of our business. Here we have excellent competencies – we manage to pull off some great deals, and our portfolio is largely composed of first-tier market companies. So we plan to maintain and develop our positions in this segment, since it would be odd to disregard our strengths. That said, the objective reality for all large banks is that nowadays the corporate business yields less revenue than it used to, so the shift towards retail made perfect sense.

— So the main reason is that margins have been declining in the bank’s existing business?

— Of course. Yields and returns on capital depend on the profitability of the bank's transactions and the risks that it assumes. At the same time, 70% of the corporate sector is roughly a hundred names, for which the top five banks are constantly fighting. The credit quality of these borrowers is generally quite good, except for a few isolated cases, but due to fierce competition, loan rates are very low, which ultimately leads to a decrease in the profitability of this business. Furthermore, in recent years there has been a tightening of regulation in banking activities, which has led to an increased burden on capital. Thus, the model whereby banks increased the assets side of their balance sheet by way of corporate customers has exhausted itself, because even when assets increase, profit has ceased to grow substantially and generate the necessary capital growth. Therefore, it’s an open secret that the retail business makes it possible not only to significantly diversify the customer base, but is still one of the most profitable areas for all major banks.

— I get your point, but how can you expand in retail when other banks have long ago made strong inroads in this segment?

— Nowadays, not only banks, but also any large institutions that work in B2C, move first of all towards digital transformation. Digital technologies offer completely different opportunities when providing millions of customers with the best quality of service, the best products, and the best speed of service in 24/7 format. And despite the fact that we embarked on this path later than our key competitors, we hold an advantage: we won’t repeat the mistakes that others have made.

One of the key success factors is a team that already has experience in similar transformation at other banks. On the one hand, they have already got the knack, and on the other, they understand well the current business context and the strengths of Gazprombank. I can cite as an example the retail loan pipeline, which took the largest players three to five years to roll out. Gazprombank developed and launched it in a year and a half, spending a significantly smaller budget. As a result, the pipeline paid off in just two or three months.

I am convinced that the winner is not the first to start the race but rather one of the first to reach the finish line. And the fact that we are so far among those catching up, on the contrary, provides excellent motivation. In other words, Gazprombank keeps running faster, while others think that they already own this market. And as history shows, this is not always the case.

— What are some of the transformation goals you have set?

— Gazprombank’s development strategy until 2022 involves transformation in many areas. This involves technology, focus on the rollout of the retail business, brand management, the restructuring of internal processes and even corporate culture.

Everyone knows that often an approved strategy is very difficult to implement, because it represents a kind of targeted vision, but does not have a final understanding of the steps and tools required to achieve the goals.

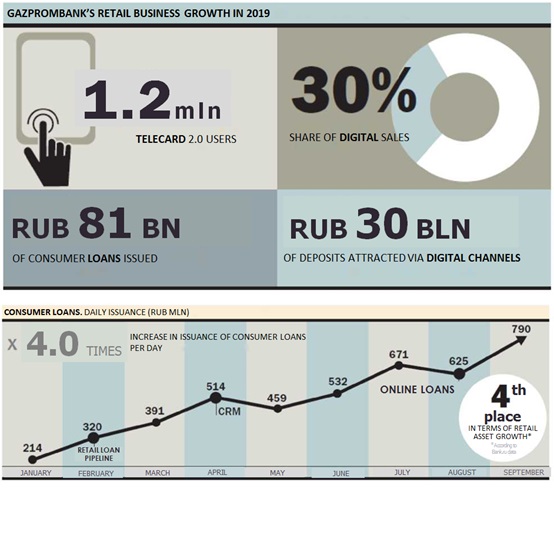

In our case, at the time the strategy was approved, we clearly knew how we would implement it — all processes, projects, programs that affect the implementation of this strategy were outlined and approved by the Board of Directors. As a result, even now, we are significantly ahead of our targets in a number of transformation projects. For example, in our new mobile bank, we hoped to double growth of the active base within one year – from 250,000 to 500,000 users, and achieve a maximum of 700,000 the following year. But now we have more than 1.2 million users! Few believed that we would be able to process thousands of loan applications on a daily basis. In September 2019, we exceeded 12,000 applications per day! This may sound like fantasy, but in reality it is only evidence that we truly found our niche and formed a team that is capable of doing this. I think this year we have seriously changed our attitude to who we are.

— You did some advertising with Pavel Volya. Could there be some hidden reason behind this move?

— Right, as a matter of fact, a lot of people have asked me about why Volya and Gazprombank came together. This is a matter of perception. We have long been perceived as a very closed bank and now we are doing our best to change this. We’re striving to show that Gazprombank has become modern, open and focused on the interests of its customers, while it is still a reliable and large-scale lender. Without changing the way we communicate with customers, updating messages and image, we face an uphill task. Volya is one of such experiments when we said that we are ready and would like to act up a little, just to prove that we have the will to change!

“The speed at which Gazprombank has changed over the last two years is absolutely unprecedented”

— Alright, getting back to the transformation, what should the bank look like once the process is complete? And what niche would you like to occupy?

—To begin with, I would like to dispel some myths about Gazprombank. People really have associated us with a bank that engineers only some top-secret deals. But this is an illusion.

Today we are the third-largest bank in the country operating in the corporate segment. We participate in most projects on the national level and scale. For many years we have been and remain one of the undisputed PPP leaders, in operations on capital markets, especially in terms of bond placement. We work with large corporate customers in various sectors, for example, and in some segments of agriculture, Gazprombank is the number one bank, even with competitors such as Sberbank and RSHB. Once we made a calculation, and it turned out that Gazprombank funded virtually all pig farming in Russia. At present, our corporate portfolio consists of first-tier market companies, and this is far from being only companies that belong to the Gazprom Group. Yes, this sector dictates certain approaches in terms of information disclosure, but otherwise we are no less open than any of our competitors.

Another myth: people say that we are not a retail bank. But here's an interesting thing: although our focus is not on retail, since we provide services to large corporate customers and their employees, we have always been the fourth or fifth largest bank in the country in terms of assets and liabilities of individuals.

Recently, when discussing our strategy, I asked my colleagues this provocative question: if you had to choose between two options – keeping your money safe or good digital service, which would you choose? So what would you choose?

— Keeping my money safe, I think

— Exactly. Why would a customer need digital service if he risks losing his money? This is the answer to the question why people chose, choose and will choose Gazprombank, for example, in terms of deposits. Because they are tired of losing money. At the same time, of course, we accept the fact that digital service is the most important service component, and here we need to look for advanced and convenient solutions, while increasing customer satisfaction. Believe me, in two or three years we will be associated with a super-retail and highly modern bank.

— What will be the relationship between retail and corporate business in the new Gazprombank?

— We have planned a significant increase in retail assets and liabilities. The most strategic issue here is liabilities, because it is a diversified long-term base that is useful not only for funding retail itself, but also for the corporate segment.

In terms of market share, we would like to almost double our growth. The share of retail in assets should go up from 8% at the end of 2018 to 14% at the end of 2022. In liabilities it should increase from 15% to 28%, respectively. These are ambitious goals, but the current pace confirms that we can achieve them. The share of retail in the bank's assets has already reached 11%. As regards the bank's fee and commission income, retail contributed 28% in 2018, and currently accounts for 54%. The target is 69%, and I see it as achievable. In general, profits from the retail business should grow from RUB 3.5 billion in 2018 to RUB 23 billion by 2022.

— Could this strong growth reflect the low base effect?

— This is a reasonable question, but that’s not how it is. Gazprombank's retail portfolio amounts to over RUB 540 billion. And in liabilities it’s 10% more. At the same time, growth targets for this year are 40% and 50%, respectively. This is a crazy pace both in relation to the bank itself, and in relation to the market. But we have already considerably overfulfilled our plans for revenue growth, making incredible efforts to outperform the market.

— So this raises the issue of where such rapid growth comes from.

—This year we launched several large technological projects, and each of them exerted a powerful impact on sales growth. Thus, the average daily issuance of consumer loans increased from RUB 200 million in January to RUB 800 million in August, and on some days it reached an issuance of RUB 1 billion. In particular, the expansion of remote channels has led to the fact that now a quarter of all consumer loans are issued completely online in our mobile bank. The same thing goes for deposits. Fee and commission income from sales has already increased ten-fold since the beginning of the year.

In August, thanks to these initiatives, Gazprombank entered the Top 4 in terms of growth in the retail asset portfolio. And by growth of deposits, we became number one in Russia, overtaking absolutely all competitors. The key factors, of course, are sales activation, a significant change in the retail management system, network operation, team motivation, and a huge technology factor. For example, the impact from updating the mobile bank exceeded our wildest expectations as the number of customers, I repeat, increased five-fold.

Incidentally, in September, our mobile bank won an award in the Quick Start category for the best application released in 2018. I have already cited the figures for users above, but in general I must say that the effect from updating it surpassed all our expectations. And next year we will present to our customers a completely new and the most advanced version of the mobile bank.

—How does the crazy retail growth that you are talking about square with the policy of the Central Bank, which has been sounding the alarm about the overheating of the consumer lending market for years?

—Indeed, at some point, the Central Bank began to tighten the screws in the consumer lending segment. But there are several important clarifications that need to be made in order to understand the specific nature of our operations. Firstly, the customer base of Gazprombank's retail customers is probably the best customer base in the country. We have 3 million active customers and an average check, for example, for consumer lending, of about RUB 500,000 compared to RUB 170,000 for the market. As for deposits, the average size is RUB 1 million vs. the country average of RUB 500,000. As a matter of fact, we are now offering some of the most favorable conditions for credit products to the highest quality borrowers. The Bank of Russia, for example, substantially tightens the provisioning requirements in the absence of a personal income tax certificate (2NDFL Form), and for our customers this certificate is already required. This says a lot about the quality of our customer base. As for the situation as a whole, I think that the main problems with the household debt burden are not due to the activities of large banks responsibly related to risk assessment, but mainly to the rapid development of the market for microfinance organizations.

—You said that to transform a business you need people who think differently. How did you form your transformation team? Where did these people come from?

—I really like Einstein’s words that no problem can be solved from the same level of consciousness that created it. Any transformation is a change, first of all, of people's consciousness, and then of technologies, processes, structure, etc. Here it is very important to learn to be open, first of all, to new ideas, and to new people.

“Gazprombank keeps running faster, while others think they already own this market”

Any bank is a super-technology organization. Accordingly, there are several components in the answer to your question. If we are talking about retail, these are retail bankers, whom we recruited individually from different banks. In 2019, they substantially revised the business model in the retail business, starting from the network and ending with product factories. The second part is technological people, many of whom came at the end of 2017 and early 2018. Without them, it would have been extremely difficult to build a new mobile bank and a retail loan pipeline for an advanced and reliable retail bank.

However, bringing in new employees is not enough. Further, we faced the task of incorporating the new people into the bank’s culture, preserving its strengths, and, after working on its weak areas, being able to unlock its potential. After all, if this is not done, what was the point in bringing them on board? Likewise, if they had come and burned down everything everywhere, including what was good, it would hardly have been regarded as success. It was not easy, but we managed to put together a united team focused and motivated for development and leadership in the market, and our business results are the best confirmation of this.

— Against the backdrop, how are we to perceive the dismissal of Vadim Kulik? How did this have an impact on the transformation and the initial results?

— This is an important issue. I am grateful to Vadim, because in a certain sense he laid the groundwork for us to start the process of change. I mean the team and the transformations that Vadim initiated, as well as many new ideas and views that I share. On the other hand, my first reaction to his dismissal was rather pessimistic: “Oh right, now that Vadim is gone we can say goodbye to the transformation”. My answer to this question is in two parts. First – the bank’s development depends not on the people who leave, but those who stay. The second issue is that such a large organization as Gazprombank cannot depend on one person. Furthermore, I believe that if any person came and changed nothing, then nothing changes just because he leaves; and if he did make changes then his dismissal would not undo these changes.

— As regards technology, what fundamental changes have already taken place in this area?

— By and large, IT is either infrastructure or software. For example, virtualization, when you come to the workplace, and you do not have a computer, but a terminal, and no matter what workplace you come to, you will work at your computer. It may sound a little boring, but virtualization allows you to switch from 3,000 physical servers to 300. At the same time, capacity is allocated for other different tasks, and management becomes more efficient. The second issue is the continuity of processes, and protection against cyber-attacks. The challenge for us is not to increase the number of customers, but to provide the capacities of all our technologies that are appropriate for business growth. In the transformation structure, a huge number of projects are combined in 18 large programs: infrastructure, changing banking platforms, building new development processes, DevOps and much more. The point is that when a bank has so many projects under development, this needs to be done in an industrial way – as an IT company, and not as a bank. Of course, there are such things as an advanced analytics laboratory, since unless you work with data you can’t build risk models. Well, a few words must also be said about our traditional focus on the safety of customers’ funds and security – one of the most important is the cybersecurity program, since digital technologies create not only opportunities, but also threats.

— Do you agree with the idea, which has been voiced specifically by Sberbank and Tinkoff, that they no longer want to be banks and that the ecosystem approach is the way forward? Are you moving in this direction or would you like to remain a bank?

— It’s difficult to answer this question unambiguously. Due to the development of digital technologies, and the influence of large digital players, it is obvious that in the first place there is a struggle for customers. Nowadays, the easiest way to access customers is digitally. There is also an understanding that people do not need a mortgage – they need a house, they do not need a deposit – they need to save money for a wedding, having a baby, education. As Bill Gates said, "we need banking, but we don't need banks anymore."

The paradox is that even though banks per se are not needed, they continue to operate due to the fact that regulation still makes them be the most reliable way in the world to save money. The bank itself must decide whether to go after customers and attempt to maintain access to them, that is, follow the path of digitalization, or not, because this is a difficult path that involves investing in technology and, most importantly, transforming consciousness.

Historically, banks were created as a system for recording accounts with the sole purpose of preserving customer funds. There was no focus on customer quality and there was no such experience. Banks have been evolving this way for centuries, and now it’s very difficult for many to change their attitude toward this process. But the choice here is obvious: either you become a digital organization and “a bit of a bank”, or you remain a conventional bank, but then you are just a settlement infrastructure with gradually decreasing profit. Then begins the struggle for customers, which happens differently, since so far no one has found a truly effective way to build ecosystems other than international digital giants.

For almost 30 years we have been building our customer base exclusively in an organic way. If we use the same methods and the same consciousness in the future, we will grow the same way or not at all. In this sense, we need to change our understanding of what a customer is: is it someone who holds an account with you, or is it someone to whom you make an interesting offer online? It’s the second option for us, and we believe that the only surefire way is to intensify growth of the customer base by developing partnerships and gaining access to partners' customers.

— How to you plan to gain such access?

“When you have a good brand, a good product and advanced digital technology, it’s not hard to attract customers”

— Let me give you an example. By working with one of our partners, we gained access to a base of 6 million customers and worked with it for two or three months. Conversions for these sales are higher than for our salary base. We counted the customer base of our potential partners and there are tens of millions of people. The question is how to work with your customers. If we learn to offer them the best financial services and the best quality of service, aren't these our customers? Yes, they are. So, it’s important that the offer to help a customer is made on time and taking into account his or her real needs. At this point, the customer can change banks and become your customer. This is an example of the ecosystem as we understand it.

— A Sberbank customer, for example, could receive non-financial services that solve his urgent personal issues. There is no need to run to other companies as all services are available in on place.

— Absolutely. But how can this be done? Is it right to buy up everything in order to build an ecosystem? And can a large organization effectively manage hundreds of types of business and provide normal service? I don’t think so.

In my opinion, it is right to follow the path of partnership with major players who know that the bank is not striving to become the core of an ecosystem and does not seek to usurp the entire economy, or customer access. The essence of a mutually beneficial partnership is the overall economic benefit gained from working with a customer. In this model, each of the service providers is a professional in his or her area, so this person will offer these services better than a bank could. Why would a bank, for example, provide medical services? It’s easier and more efficient to enter partnership projects with medical companies, where the bank will pay not for the customer base as such, but for the fact that the product was issued. Recently, we made an ecosystem solution with Gazprom Neft’s retail filling station network. In their application, we issued a Gazprombank virtual card, which replaces the loyalty system. In August, the project was launched on Android, and in October we plan to release it on iOS. Currently 3,000 such cards are being issued on a daily basis. As soon as we see that this project is effective, we will begin active marketing, and some of these people will become our customers. After starting on iOS, we expect that we will issue up to 100,000 cards a month! If you develop this ecosystem further, you can issue such a card in an application of any of our partners, their users will receive higher cashback rates or more discounts, and we and our partners will have access to millions of customers.

But this is more of a conceptual illustration, and for the time being we are simply experimenting with partnerships, but we are definitely not going to buy up everything to expand the product range or customer base as this is not our strategy.

— Generally speaking, how do you see the competitive field in 2022? Who will you be competing against – banks or fintechs?

— Russia is considered a leader in digital banking, fintech. It is noteworthy that the largest number of tokenized card payments in the world takes place in Russia. These are electronic wallets or payments in a mobile bank. Our banks are quickly modernized and digitalized, so in any case, our competitors are still the same: Sberbank, VTB, Alfa…

I believe that the main competition will focus on digital access to customers. And in this sense, we understand how to make their number grow steadily. We can offer truly interesting products. An example is our “Smart Card”, when the customer does not need to choose categories with increased cashback accruals, the bank itself awards the maximum bonus for the category where the person had the most expenses in a month. No one has such a product on the market, and when you have a good brand, a good product and advanced digital technology, it’s not hard to attract customers.

What will happen next? Margins will probably shrink, because the main players will replicate each other's products, and at some point the question will arise about who has more new ideas and who has gained the best customer experience. But in general, I am convinced that the main thing today is the speed at which a bank is able to change. The core issue is who will reach the customer faster, with what product and service quality. In this sense, we are the most dynamically developing bank in Russia, which is able to make decisions very fast. You can’t even imagine how fast.